American investment bank Morgan Stanley has indicated that Egypt’s reform program, including EGP flotation and successive rounds of subsidy cuts, alongside public investment in infrastructure, energy, and various megaprojects, have put it “on track to become a breakout nation,” Invest-Gate reports.

“At a time when a secular slowdown in the global economy is lowering the definition of rapid growth… any country at Egypt’s stage of development, with an average income under USD 5,000, is doing well if it is growing faster than 5%. And we think Egypt is on track to grow as fast as 6% in coming years,” Morgan Stanley’s Head of Emerging Markets and Chief Global Strategist Ruchir Sharma said in a report published in early August.

published in early August.

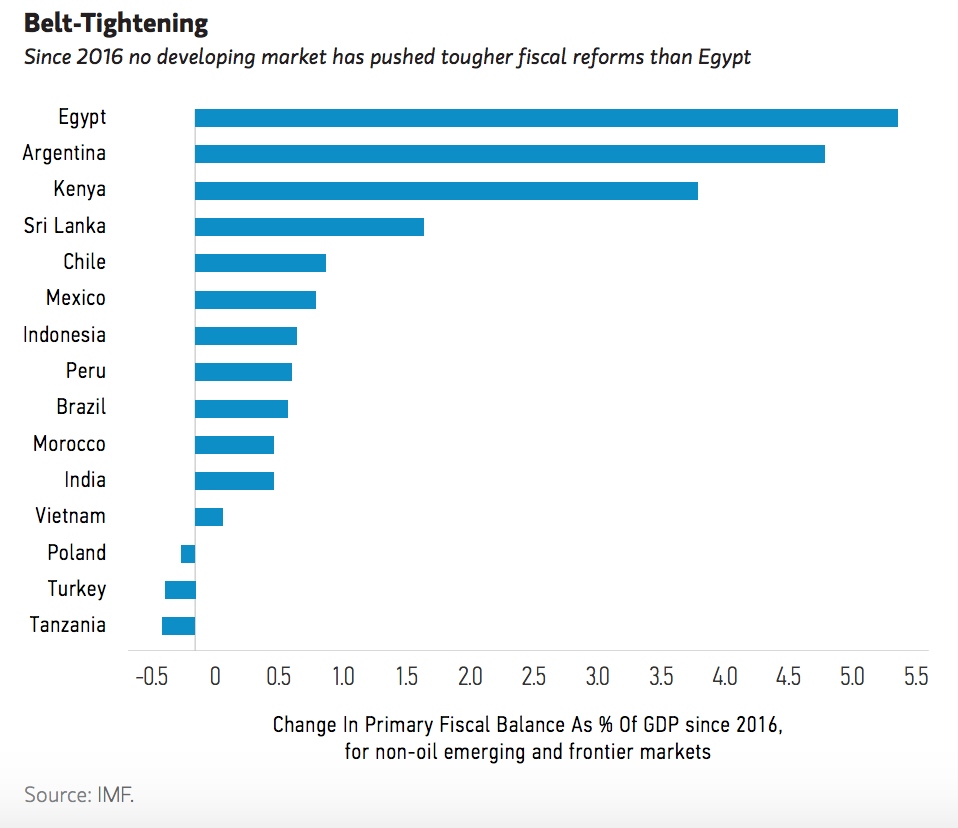

The report, entitled “Tales from the Emerging World,” described Egypt as the “best reform story in emerging markets,” due to the implementation of a diverse range of economic reforms since November 2016.

Sharma deemed Egypt’s long-term aim of becoming a low-cost manufacturing hub as difficult amid the growing trend toward deglobalization, however, he pinpointed that “the cheap currency and the large domestic market have drawn foreign direct investment from regional players.” But, he noted that some business executives say foreigners would unlikely to invest heavily before they see local companies expand further first, which is “yet to happen.”

“We are optimistic for Egypt, which is now moving past fiscal reform to focus on measures to increase private sector competitiveness, including tax cuts for small- and medium-sized enterprises and land reforms … We will be watching progress closely, knowing investors will flee at the first sign that [President Abdel-Fattah] El-Sisi’s reform discipline is faltering,” the market analyst concluded.

Egypt’s annual headline inflation rate declined to 8.7% in July from 9.4% a month earlier, falling to a four-year low, despite the recent rises in fuel prices between 16% and 30% in July and new electricity subsidy cuts coming into effect.