A tax means a financial charge imposed on a taxpayer by a governmental organization; this is the simplest definition of taxes that people knew throughout the years, but the new regulations that Egypt is witnessing in the real estate sector and the current property tax that the government is imposing create confusion and questions like who should pay and how.

Therefore, Invest-Gate collects all the vital info to give you the core of this tax without complexity.

1- History of the Tax: The real estate tax has a long history in Egypt. It was known before as (El Awaid).

2- The First Law of the Real Estate Tax: The government first Imposed it in 1950 with certain rates on residential units. People started to know it with the name of the real estate tax with the issuance of Law No. 196 in 2008. The law back then limited the tax on real estate units to one category, which is 10% of the unit’s rental value.

3- Taxes for All: Every property owner has to pay a real estate tax.

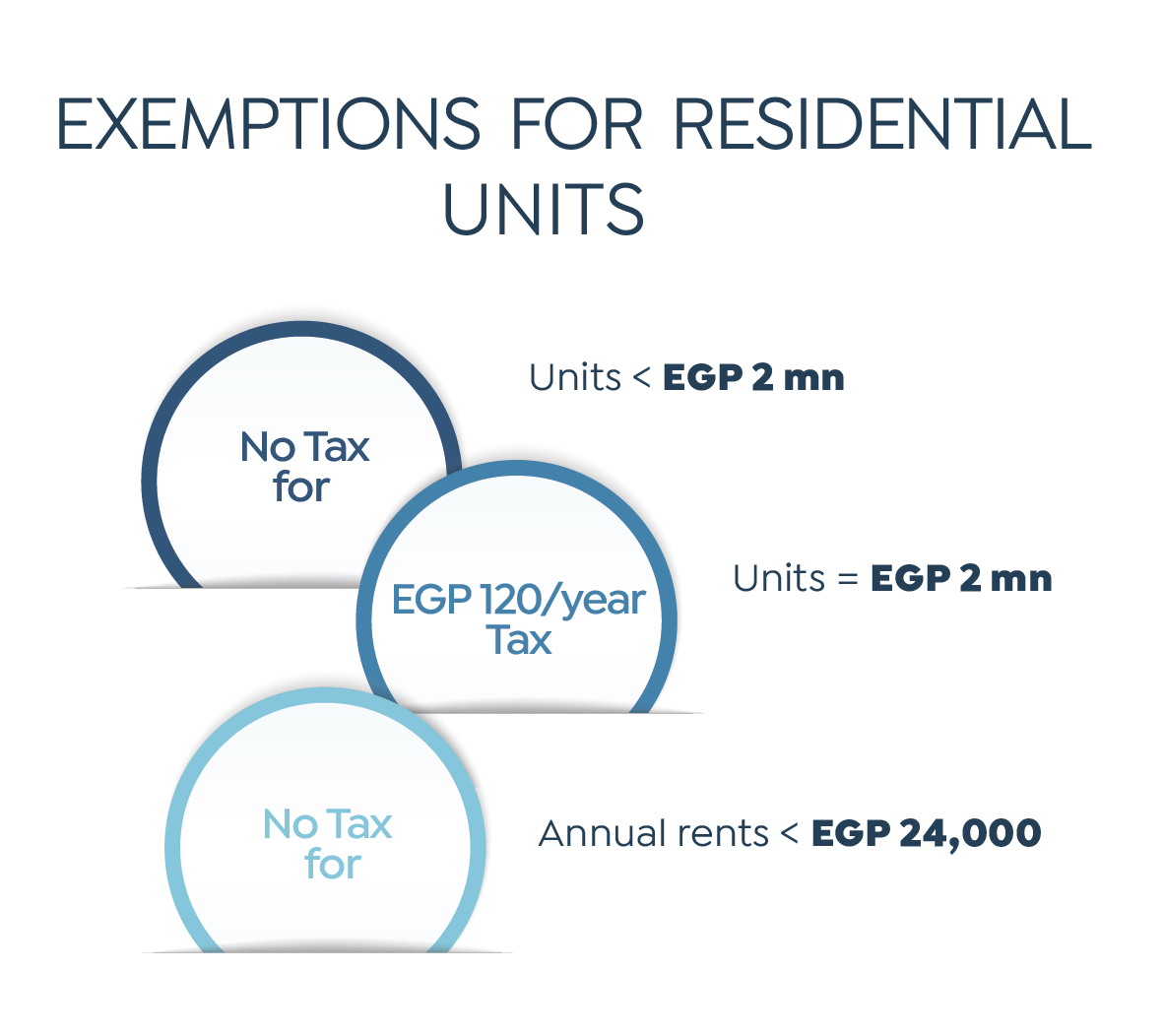

4- Exemptions: There are some exemptions for the residential, non-residential units, and unbuilt land plots. For the residential one, every property owner has one exemption for the first property with a value that doesn’t exceed EGP 2 mn, and for the unit of EGP 2 mn value, every owner should pay EGP 120 per year. Moreover, residential units with an annual rental value that does not exceed EGP 24,000, are exempted from taxes.

The non-residential units also have exemptions for the educational units, mosques, churches, cemeteries, and nonprofit organizations.

Moreover, exemptions also apply for the commercial, industrial, administrative units with an annual rental value less than EGP 1,200.

5- The New 2.5% Tax: With the new regulations, the value of real estate tax has been reduced from 5% to 2.5%. It is to be applied every ten years on the property within the city cordon.

6- Real Estate Tax Payment: The government used to get the real estate tax from the property owners through cash payment, but with the new regulations it turned to be electronic.

7- Real Estate Tax for Rented Properties: the renter doesn’t have to pay the tax but if the owner couldn’t pay, the renter alternatively pays.

8- Exemptions for the Non-Governmental Foreign Properties: The non-governmental foreign properties don’t pay tax, but the government has to check the circumstances of these countries’ organizations whether it is the same or not.

9- Within the Old Renting Law: The new law requires dealing with these properties with the same rental values of the properties under the system of determining the rent.

10– Paying the tax: The Tax Authority has provided two ways to pay the real estate tax either online or traditionally in person. The due date for paying is in March 2021 as the taxpayer can go to any real estate tax office nationwide to submit the tax or through the “Digital Egypt” platform https://digital.gov.eg.

These crucial updates on the new real estate tax law in Egypt have raised many questions and concerns for property owners. Therefore, please share with us your opinion about the new regulations; what do you think about it? Do you agree or not?