Commercial real estate represents one of the main pillars of the Egyptian property market with sectors such as office, retail, and hospitality contributing effectively to the overall growth of the market and playing a leading role in driving the entire economy. Invest-Gate tries to offer a glimpse into these sectors’ performance over the year-to-date period, analyzing the recent data and highlighting the most important opportunities and challenges in the market.

Part 2: Retail

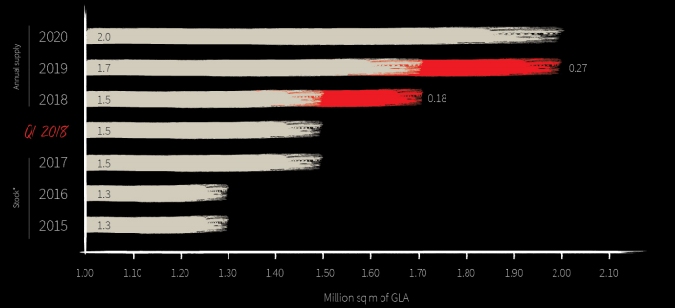

Retail Supply in Q1-2018. Source: JLL

The retail supply witnessed a slight expansion during the first three quarters of 2018, while a further increase is expected to take place by the end of 2018, as constructions are undergoing in new projects.

Retail Supply in Q2-2018. Source: JLL

Both retailers and developers started to adapt to the new market changes, maintaining a healthy performance in the retail rents following the sharp drops in the past two years after the currency devaluation, according to data collected from JLL’s reports for Q1, Q2, and Q3.

Data also showed that prime super regional malls’ rents posted sustainable rises in the first nine months of 2018, inching up by an annual rate of 10% YoY in both Q2 and Q3. However, the secondary malls and retail complexes, which saw a drop in their rents during the first three quarters of 2018, declined by 11% YoY in Q3.

Retail Supply in Q3-2018. Source: JLL

JLL Country Head in Egypt Ayman Sami comments on the previous figures saying:

“The local demand marks the main driver of this sector’s performance, yet the spending power is now turning downwards with the rise in prices, leading to a decline in secondary malls’ rents as they are mostly quoted in EGP.”

“However, the prime super regional malls, which their transactions were carried out at fixed prices in USD, saw a positive performance in their rents.”

Mansoor Ahmed, director of Development Solutions, Healthcare, Education, and PPP at Colliers International MENA, says:

“The success of Cairo’s primary super regional malls can be attributed to Greater Cairo’s fast-growing population and the radical changes in demographics that create a demand – likely to remain high – for lifestyle shopping destinations with expressive entertainment and leisure components.”

“Emphasis needs to be realigning the tenant mix to reflect the target demographics and affordability levels. Food & beverage (F&B), entertainment, and leisure components are likely to attract visitors to the secondary malls and result in higher revenues.”

“Several new projects are now under construction in different locations such as the new LuLu hypermarkets across 6th October City, New Cairo, and Obour city, in addition to IKEA’s mega store in Mall of Arabia, west Cairo – which is expected to open in the new future.”

For his part, Oxford Business Group’s Editorial Manager Kevin Graham adopts a positive view for the sector as he expects an increase in the retail market vacancies over Q4 and into 2019 due to new spaces becoming available.