As real estate consolidates its place as one of the prime sources of investment revenue in the country, property resale value has increasingly become one of the major determinants in any investment decision – from a small-scale individual homebuyer to a leading conglomerate looking for the ideal commercial space.

While a large number of average Egyptian home sellers tend to sell individually, in hopes of cutting out any extra fees that may be incurred through a third party, this often entails long waiting periods, potential legal hurdles, and limited access to potential buyers. For the average home-seller, there are a number of options when it comes to property resale, most prominently selling through a real estate developer’s resale department, a real estate agent, an online listing platform, or to sell the property independently through their own individual effort.

For the average home seller, property resale has a number of variables that can either substantially maximize or entirely diminish the resale value of their property. Moreover, the process of selling a property can be quite thorny on its own, whereby finding the right buyer with the appropriate financial options is not always a walk in the park.

Additionally, completing the paperwork and legal matters in order to sell your property is often a long-winded affair, requiring ample time and know-how. Real estate developers and agents, on the other hand, each offer their own specific advantage, some of which overlap, but many of which are tailored towards a specific clientele.

Real Estate Agents Widen Reach

Property resale through an agency comes with a set of advantages, whereby real estate agencies oftentimes have a wider scope in terms of potential buyers, as well as extensive experience in the property resale field. This is likely to shorten the time it takes to sell a property, thereby potentially maximizing resale value.

“If we are talking about selling a property, real estate agents have much higher exposure and more platforms for clients, such as digital presence, multiple listing service, listing through their websites, and a wide database of buyers/requests, and so a property that you sell independently in three months can be sold through an agency in a week or two, and in terms of property resale, time is money,” said Karim Ghoneim, Head of BYC, a real estate agency and consultancy.

“As real estate agents, we already have someone who is looking for the specific type of unit that somebody else potentially wants to sell,” he added.

In addition, a real estate agency will take care of all legal issues and paperwork related to the sales operation, ensuring that both sides are within their rights and meets the dictates of real estate laws, thereby essentially cutting out much of the time-consuming procedures associated with the sale operation.

Ghoneim believes that agents have a major edge over developers, as this is their field of expertise, and making a sale directly benefits them.

In terms of selling a commercial property, real estate firms can provide consultancy services in order to determine the value, clientele, grade, and type of property, as well as other factors that determine the selling process. Further, Ghoneim pointed out that, in many cases, it is more profitable to rent out office space than to sell, due to income potential.

“The best reason to invest in commercial over residential rentals is the earning potential. Commercial properties generally have an annual return from the purchase price ranging between 6% and 12%, depending on the area, which is a much higher range than typically exists for single family home properties, which is 2% to 4% at best,” he continued.

Additionally, commercial properties have the advantage of more objective price evaluations. “It’s often easier to evaluate the property prices of commercial property because you can request the current owner’s income statement and determine what the price should be based on that. If the seller is using a knowledgeable agent, the asking price should be set at a price whereby an investor can earn the area’s prevailing cap rate for the commercial property type they are looking at,” Ghoneim noted.

“Renting office space is more profitable because of both the value of the rent and, and the value appreciation per annum of the property,” he noted.

Developers Introduce Resale Schemes

In recent years, most major developers have begun introducing departments specifically dedicated to property resale, with services tailored specifically for homeowners in search for potential buyers. Among these are SODIC, Emaar, Palm Hills, Mountain View, and the Talaat Mostafa Group, among others, which offer resale services within their own developments, alongside many other news developers.

For those who own homes in compounds built and operated by large-scale developers, this has clear advantages, whereby the homeowner needs to look no further than the compound itself to seek out buyers; not to mention that most buyers looking to purchase property at a given compound are bound to go through the developer anyways, thereby ensuring that supply meets demand.

A buyer looking to purchase a home in a compound or from a certain developer is looking at a relatively small market, thereby increasing potential exposure for the seller’s property, and in turn decreasing the time it takes to actually sell the property once it is advertised on the market.

Further, a property is unlikely to lose value if sold through the developer, as property prices at the majority of compound necessarily appreciate over time, often at a higher rate than in other areas of Egypt, thereby ensuring a profit for the seller, even in the cases where a fee is incurred.

Drawbacks

Property resale through developers and real estate agents comes with some disadvantages in both cases, and anyone wishing to sell property must take a number of factors into account, including the location, type, and size of the property being sold, among others.

Selling through a real estate agent could potentially cut out part of the property’s profitability due to the commission; however, property ownership is tied with liquidity risk, and waiting too long to sell a property could also translate to potential losses. Thus, a seller must balance out between selling with a potentially high commission with the possible losses that may result from selling independently.

Meanwhile, one of the most obvious disadvantages of selling property through a developer is that the property must have been purchased from a developer in the first place, and a developer with resale services in the second. In many cases, those who own more centrally-located properties did not contract through a developer, and therefore must seek to sell a property through different means.

Furthermore, Ghoneim contends that “most developers did not have resale departments until a few years ago, when the real estate industry began to boom. It is not to their [developers’] advantage to have a resale department, because they already have an inventory to sell, and when one phase of a project is sold out, they begin selling the inventory for the next phase at a higher rate, so they don’t want to be selling things from previous phases.”

Other Influencing Factors

Prior to resale, a number of other considerations should be made, whether through a real estate agent or a developer. Both the buyer and the seller must ensure that the contract is sound and foolproof, protecting both their rights in the process. This involves ensuring that the buyer has enough liquidity to make the purchase, and included clauses in the contract that safeguard the seller’s rights if payments are not made or are delayed.

Similarly, both parties must ensure that legal registration of the property is taken care of, and that there are no prior legal issues or contestations over ownership. However, unless the seller is undertaking these transactions independently, both real estate agents and, in most cases, developers ensure that legal details are straightened out.

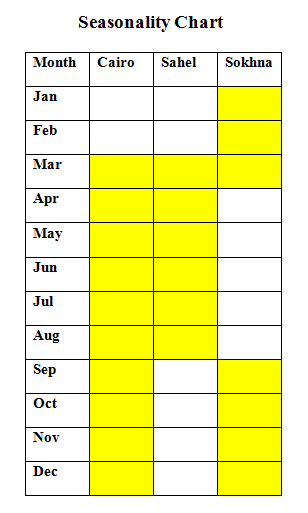

Another important factor to keep in mind is seasonality (see chart). “Sellers shouldn’t sell during Ramadan. Peak season begins in mid-September and ends around Christmas, and that’s when people should be looking to sell,” said Ghoneim.

“However, sellers should also consider the type of property, as seasonality changes between one type and another. For example, if you are selling a second home in Ain Sokhna, you are looking at different peak seasons,” he elaborated.

In conclusion, there are numerous factors and determinants influencing property resale, and these are largely governed by a fluctuating real estate environment that responds to the flux of supply and demand. While some factors fall outside of the realm of individual control, it becomes a question of how to use those factors to one’s benefit, given the aforementioned determinants, such as location, type of property, legal status, and more. Yet, given the overwhelming trends of the Egyptian market to sell independently, those who have begun to break the mold are promising to reshape the property resale market for future generations.