The real estate market is flourishing today, creating new trends and fading old ones. Invest-Gate gives you the complete guide on property purchase across the capital.

“Many think of real estate investment as a money pot,” Vice President of Coldwell Banker and Coldwell Banker New Homes Mohamed Banany tells Invest-Gate.

The Current Purchase Trends

One recent development in the real estate market is the increased decline in speculators, or short-term real estate investment, where the investor buys a unit and sells it quickly for a profit. Instead, medium- and long-term investments have become more dominant in the market. This is due to a number of reasons, including some developers’ putting restrictions on selling units until owners pay 25% of the property’s value, waiver fees on housing units could reach from 5% to 7%, which limits investors’ profits, as well as, limited liquidity in the market.

Another real estate rising investment trend, according to Banany, is investing in small spaces. Small residential units are lower in prices, so they would suit more incomes, and are easier to both sell and rent.

“For the time being, people are looking at the new capital more for investment,” Banany states.

A fourth pattern is closing the purchased unit rather than renting it.

“There are around 11 mn uninhabited units in Egypt,” Fathallah Fawzy, MENA Group founder, has estimated during Invest-Gate’s strategic real estate roundtable. JLL’s report predicts that “rents are expected to increase in 2018, due to extended delays in the delivery of products within gated communities.”

It is yet to be seen if the increased demand in rent will be met with an increased supply.

How To Make The Best Purchase

Investing in real estate continues to be one of the safest investments, however, there are a number of aspects to consider for a higher return on investments. Invest-Gate provides a guide for families wishing to invest in the market.

1) Location

“The number one thing to look at in regards to real estate investment is location, location, location,” he stresses, adding that the selection of a prime location is multifaceted; it involves the selection of the district, then the location of the project within the district, followed by the location of the residential unit inside the project. “The district should be close to services and amenities such as universities, hypermarkets, and hospitals.”

2) Think Long-Term

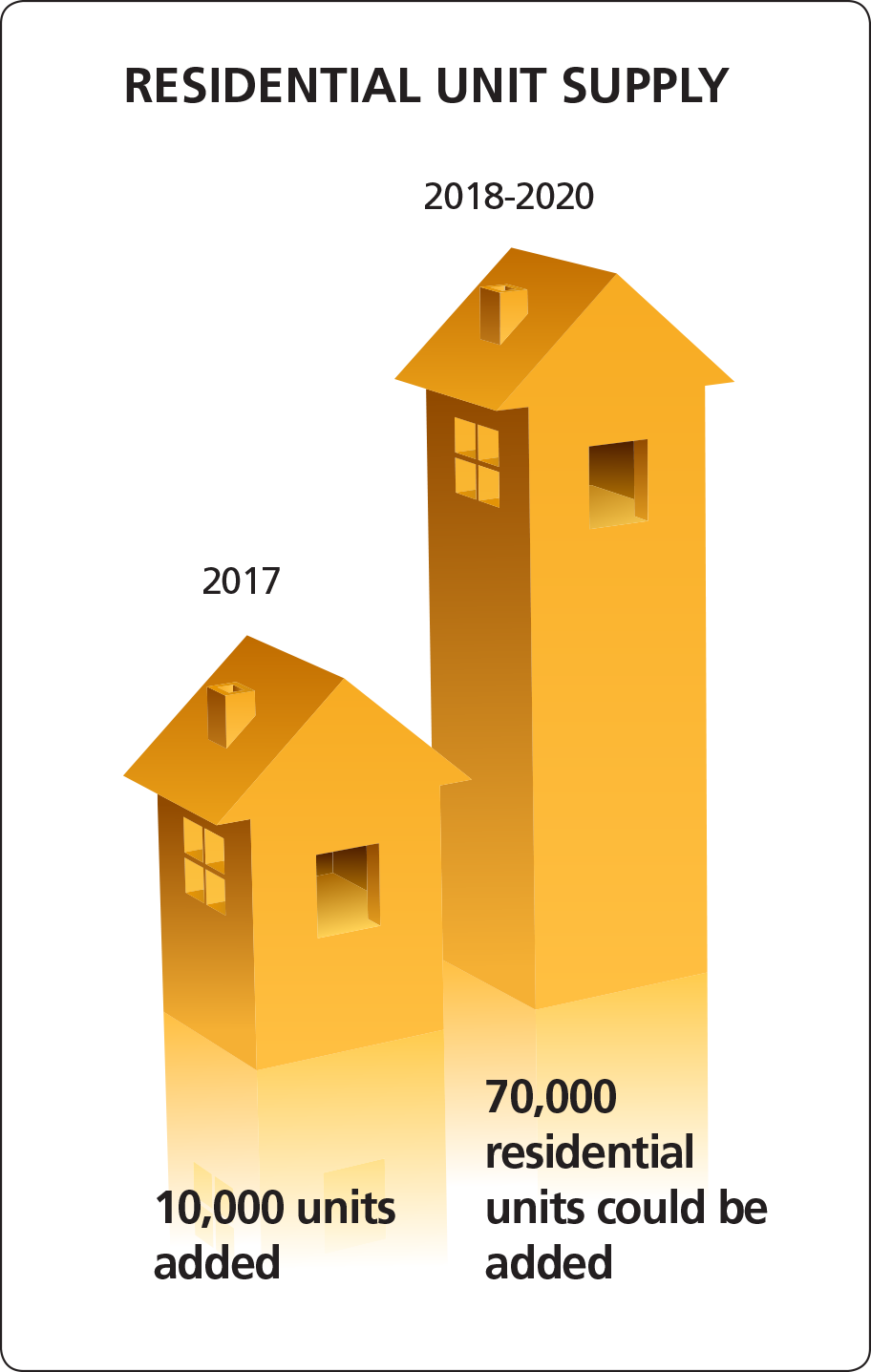

A number of developmental projects have been built and are currently under-construction in the country and this rapid construction is bound to reflect on the real estate market.

The key is to keep track of the developments taking place and think long-term of the possibilities of each area in order to have a higher return on your investments. Case in point is Ain Sokhna, which is currently undergoing a number of mega investment projects such as the Ain Sokhna Industrial Zone.

“Ain Sokhna is gradually turning from a second-home hub to a first-home location,” Banany reveals, adding that the rental value is expected to increase because of foreigners, who would work there and would want to rent properties.

3) Trusted Developers

An important aspect of selecting a residential unit is making sure that it is developed by a strong, trusted developer. Make sure to do your research on the developer’s previous projects to ensure that they deliver on time and execute all services and amenities they promise.

4) Payment Plans

Invest-Gate concludes during its Strategic Roundtable that a number of measures have been introduced to protect the market activity and those include offering extended payment plans, and installments with zero interest rates. With a multitude of payment plans available and installments reaching up to 10 years, investing in real estate has been made easier.