The saturation of Egypt’s hospitality market with luxury developments at one end and the undersupply in the mid-market at the other have raised a flag for Invest-Gate to explore possible investment opportunities and benefits in midscale hotels, while examining the segment’s potentiality and success factors, as well as, the major obstacles hurdling the model’s development nationwide. What makes a successful mid-market hotel? Basically, a typical mid-market branded segment is known to encompass hotels straddling three- and four-star properties, categorized as business inns, resorts, boutiques, and full- or limited-service hotels. In terms of capacity, the typical land plot that can accommodate 250 five-star hotel rooms may instead boast over 500 mid-market hotel rooms due to having lower sizes, which usually vary between 15 and 25 square meters each, according to UK-based professional services firm PwC’s 2016 report, entitled “The Great Mid-Market Hotel Debate.”

“It is essential for mid-market hotels to have a strong competitive brand, hence attract more bookings from corporate businessmen,” sees Christopher Lund, head of hotels for the MENA region at Colliers International.

Having millennial travelers as the target clientele in mind, the introduction of strong loyalty programs, which offer customized benefits, is vitally important as it makes customers leverage a preferential treatment, he believes.

Mid-priced hotels can utilize this for its advantage by setting online promotion strategies to reach out to a wider proportion of millennial clients. Hotel owners should embrace social media to maintain awareness of young travelers’ preferences, as they will probably use a couple of online platforms to post opinions and reviews. Accordingly, developers and owners should tailor their hotel services, GlobalData’s 2018 study highlighted.

“Over and above, a well-connected spot with city centers, marketed at an attractive price, is a great value proposition for mid-market hotels,” says Head of Savills Egypt Catesby Langer-Paget.

After all, doing away with the frills and trappings of luxury hotels, a special focus on providing a clean and comfortable room, with trendy food and beverage (F&B) offerings, can be a great draw for millennial travelers, he adds.

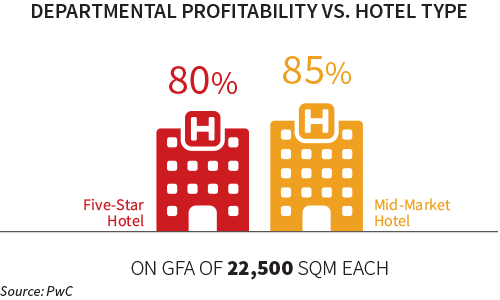

Investment Perks  Market experts agree that developing a midscale hotel can generate the same amount of cash that five-star properties’ owners/developers earn.

Market experts agree that developing a midscale hotel can generate the same amount of cash that five-star properties’ owners/developers earn.

If situated in the right location, with an appropriate or strong demand profile, this kind of hospitality product could deliver superior investment returns relative to a luxury offering, Langer-Paget asserts.

This due to the mid-range hotels’ lower development and staffing costs, coupled with lesser room sizes and landscaped areas, lax requirements for ancillary facilities and recreational activities, on top of more efficient designs, Colliers’ Lund and Langer-Paget highlight. This all translates into lower operating costs, whereby driving higher operating margins in shorter periods, both hotel consultants agree.

Some Hurdles Along the Way Among the main challenges are the high land prices in prime locations, which lead to the unfeasible economics of building a mid-market hotel.

“This factor often deters investors for it would make mid-market hotels a lesser attractive investment opportunity, compared to five-star luxury properties.” One more quoted hurdle is ensuring the development of adequate public infrastructure in second tier locations, where mid-market hotels make more sense. The government has to ensure lending from banks for small and medium investors to promote investments into this sector, according to Savills’ Langer-Paget.

Promising Future Ahead  On a global level, millennials exclusively constitute around one-fifth of international tourists and generated over USD 180 bn (EGP 2.9 trn) in annual tourism revenue in 2016, a number that is expected to increase further in the upcoming years, according to Millennial Traveler Insights by Global Data in 2018.

On a global level, millennials exclusively constitute around one-fifth of international tourists and generated over USD 180 bn (EGP 2.9 trn) in annual tourism revenue in 2016, a number that is expected to increase further in the upcoming years, according to Millennial Traveler Insights by Global Data in 2018.

On the bright side, Langer-Paget expects the pool of demand to widen as the government targets new source markets and traveler demographics, as well as, works to develop the present tourism infrastructure and connectivity. Meanwhile, he notes that the EGP devaluation is already making the market more appealing to cost-conscious visitors, boosting the need to further develop the mid-range hotel offerings.

For his part, Lund foresees the introduction of new and exciting mid-market international lifestyle brands into Cairo and selected key resort markets in the near future. He also foresees that some higher positioned properties will be refurbished and rebranded into mid-range hotels.

As for Marloes Knippenberg, CEO of Kerten Hospitality, the North African country is undoubtedly ready to welcome fresh new concepts of trendy mid-market options, which are likely to play a key role in boosting the overall performance of the entire industry.

All in all, Egypt should address the skew of its hotel supply toward the luxury hotel sector and draw more three- and four-star hotels into the mix. Recognizing the importance of combining quality assurance with value for money will push industry stakeholders to capitalize on evolving consumer patterns, which focus on experiences over excess spending. The resultant effect is that the industry will have more modern mid-market properties that are branded, operated, and developed with the modern traveler in mind.

To explore the mid-market hotel world, read pages 24-26 at Invest-Gate’s November issue.