Bio: With over 15 years in financial consultancy and equity research, Gad is currently a senior equity analyst at the AAIS, after joining the company’s first research team to cover the Egyptian property sector in early 2018

By Mahmoud Gad, Senior Equity Analyst at the Arab African International Securities (AAIS)

Recently, the Central Bank of Egypt (CBE) has announced a new mortgage finance program to support the middle-income segment. The long-awaited initiative offers mortgage loans at lower interest rates and longer payment terms. This comes at a time when the real estate sector is experiencing a slowdown due to the increased property prices, coupled with weak consumer purchasing power. So, the question here: Will mortgages keep the wolf from the door?

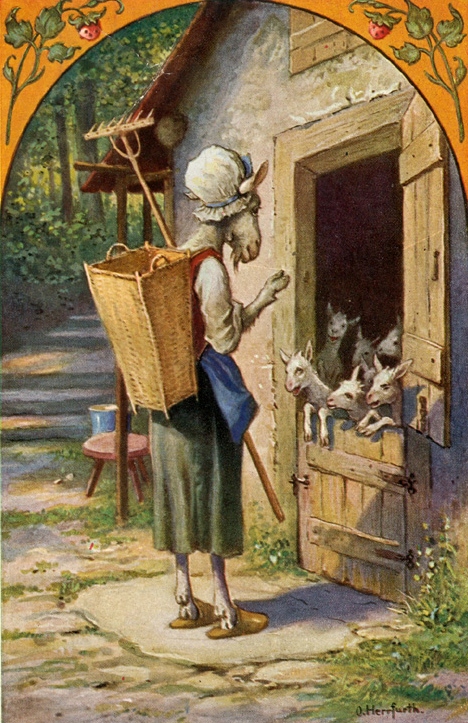

The Wolf and the Seven Young Goats

A while ago, I was reading to my daughter “The Wolf and the Seven Young Goats.” It is a renowned bedtime story/fairy tale that portrays how parents are always alert and keen to keep their children safe; it also teaches kids to heed advice from their parents. Briefly, when the old mother goat left home to go to the market, she warns her young to not let strangers in, especially the Big Bad Wolf who will try to sneak into the house and gobble them up. Indeed, as soon as the mother was out of sight, up he trotted to the door and knocked. But, in the end, the mother returned home from the forest and saved her little ones from the wolf.

“The Absence of the Mother Would Have Put the Kids at Risk”

The Wolf is Knocking the Door

After the EGP flotation in November 2016, the local demand for real estate – be it for residence or investment purposes – witnessed a slowdown due to weaker purchasing power and higher interest rates. Moreover, the entrance of new players and the launching of new developments worsened the situation. Aiming to stimulate the consumer demand and maintain the declining market shares, developers started to extend installment terms to over eight and ten years, while requiring 0-15% downpayments. In turn, this has negatively impacted developers’ cash flows as well as their projects’ feasibility, hence exposed to execution risk due to liquidity tightness. Moreover, cash borrowing may expose these companies to default risk if the market stagnation kept going. However, should developers fail to deliver the planned projects, clients may lose their savings as a consequence.

“Real Estate Developers and Clients are Surrounded by Many Risks”

Keeping the Wolf from the Door

“To Keep the Wolf from the Door” is an old expression that describes making immense efforts to avoid hunger, starving, bankruptcy, and the like. Currently, there are several catalysts expected to contribute to keeping the wolf from the real estate sector’s door. With the CBE resuming its easing policy, alongside the provision of the mortgage finance initiative, which mainly targets those falling under the upper-income bracket, the demand in the secondary market (aka resale) is foreseen to witness a recovery over the medium-to-long term, which would eventually push for demand in the primary market.

However, on the one hand, the current requirements to obtain mortgages need to be more flexible. On the different, more regulations should be promptly proposed to protect the clients’ rights and savings, while also organizing the entrants of new players to the local property market. For the time being, I look forward to these issues being untangled amidst the issuance of Egypt’s Real Estate Development Law.

“Initiatives and Regulations to Keep the Wolf from the Door”

A great starting point to a new year is to get to know all about the real estate market top forecast, therefore explore Invest-Gate’s January issue to savvy where the sector is heading in 2020!