Introduction: Real Estate’s Digital Crossroads

As global property markets accelerate their digital transformation, a critical question dominates industry discourse: Will blockchain remain a support tool or become the backbone of real estate by 2030? Once associated solely with cryptocurrencies, blockchain has rapidly evolved into a trusted infrastructure for land registries, smart contracts, tokenized assets, and AI-integrated analytics.

This article explores how blockchain technology is set to redefine the future of real estate by analyzing five key transformative trends. First, it examines how blockchain is evolving from a support tool into the digital backbone of infrastructure and regulatory compliance. Second, it looks at the rise of tokenization and its potential to democratize access to real estate investment. Third, the article considers how AI-driven property valuations, when combined with blockchain-secured data, can bring unprecedented accuracy and transparency to market pricing. Fourth, it delves into the emergence of virtual real estate and the growing relevance of the metaverse as a new frontier for property ownership. Finally, it addresses the critical role of regulatory frameworks—whether enabling or limiting—that will shape the pace and scope of blockchain adoption across real estate markets.

Each section will examine how blockchain’s role is shifting from support tool to foundational architecture. The article draws from global examples, emerging data, and Egypt’s progressive steps in the space.

Is Blockchain a Tool or the Backbone of Real Estate by 2030?

By 2030, blockchain will move beyond being a complementary tool to becoming the core operating system of real estate markets. Just as the internet became the backbone of modern communication, blockchain is set to underpin property ownership, registration, transactions, and investor protection across both physical and digital assets. Blockchain—a decentralized digital ledger technology that records transactions across multiple computers—ensures transparency, security, and data integrity. Once a transaction is added to the blockchain, it becomes immutable, making it an ideal foundation for verifying ownership, reducing fraud, and streamlining real estate processes. In this vision, real estate professionals will no longer merely use blockchain tools—they will operate within a blockchain-native ecosystem, where smart contracts automate transactions and trust is embedded in the system itself.

- Blockchain as the Backbone: Global Momentum

By 2030, blockchain is expected to serve as more than a digital ledger. It will likely underpin critical real estate infrastructure, including land registries, title transfers, escrow services, compliance frameworks, and even urban planning permissions.

- Estonia has used its blockchain-powered e-Land Registry since 2014, streamlining ownership updates.

- Dubai launched the Dubai Blockchain Strategy aiming to digitize all government documents, including real estate, by 2027.

- Egypt made its entry into the blockchain-enabled real estate landscape in July 2025 with the launch of its Unified Real Estate Platform. The platform seeks to reduce property registration time by integrating with civil databases and employing automated verification processes. While it does not represent a full tokenization model, it is widely seen as an initial step toward a broader tokenization strategy for Egypt’s real estate sector.

Blockchain’s immutable nature enhances legal certainty—enabling smart contracts that execute automatically upon predefined conditions. This reduces friction, intermediaries, and bureaucratic delays.

- Tokenized Ecosystems: Democratizing Investment

Tokenization—converting real estate into tradable digital tokens—is unlocking access to the property market for smaller investors. Through blockchain, users can own fractional shares of real estate, access secondary markets, and diversify their portfolio.

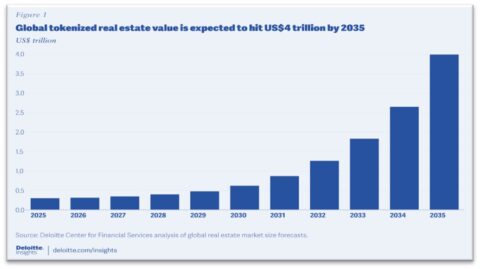

According to a report by Deloitte published in April 2025, real estate tokenization via blockchain represents a fundamental shift in how property assets are owned and traded. By converting traditional real estate into digitally tradable units, this technology enables individual investors to purchase fractional shares of high-value properties—an opportunity once limited to institutional players. This significantly lowers traditional financial entry barriers and broadens participation in the real estate market. The report projects that the global tokenized real estate market could reach up to $4 trillion by 2035, driven by a strong compound annual growth rate (CAGR) and growing market confidence in the tokenization model.

Source: Deloitte Center for Financial Services

Platforms such as RealT in the USA, Proptee in the UK, and Brickblock in the EU are democratizing real estate investment by enabling fractional ownership through blockchain. RealT, one of the early movers in the U.S., allows investors to purchase tokenized shares in verified rental properties with over 200 properties and $10 million in tokenized value.

In the UK and EU, Proptee facilitates investment in residential real estate fractions that can be bought, sold, and traded instantly on a blockchain-based platform, with minimum investments starting as low as €1.Meanwhile, Brickblock, celebrated as Europe’s first real estate tokenization platform, completed its inaugural tokenized property deal in Wiesbaden, enabling fractional ownership among users. Tokenization offers liquidity in an otherwise illiquid sector and democratizes access to global real estate, allowing diaspora and retail investors to contribute to national development securely.

- AI-Powered Valuations: Precision at Scale

The convergence of artificial intelligence and blockchain is revolutionizing real estate valuations. AI algorithms now digest vast datasets—ranging from location analytics, rental yields, and demographic shifts to sustainability indices—while blockchain guarantees the immutability and traceability of every input and output.

The global industry leaders such as JLL and Colliers are piloting hybrid systems that combine AI-driven market analysis with smart contracts secured on the blockchain. These innovations automate due diligence, risk assessment, and legal verification processes, reducing human error and speeding up transactions.

Globally, market data demonstrates surging adoption: approximately 65% of real estate firms plan to increase AI investments in the coming two years; 73% of commercial investors view AI as crucial to future success; and firms using AI report gaining a strong competitive edge in pricing, marketing, and tenant management. The AI‑powered real estate market, valued at $2.9 billion in 2024, is projected to soar to $41.5 billion by 2033, reflecting a compound annual growth rate (CAGR) of around 30%.

In Egypt, the newly launched real estate platform integrates Multiple Listing Service (MLS) standards with AI tools. This setup helps detect fraudulent or duplicate listings, generate real‑time price forecasts, and enhance transparency—creating a valuation environment comparable to New York or Dubai’s established frameworks.

By 2030, AI-powered tools will likely be embedded in smart contracts to trigger dynamic pricing, rent adjustments, or refinancing based on real-time data.

- Metaverse Plots: A New Asset Class?

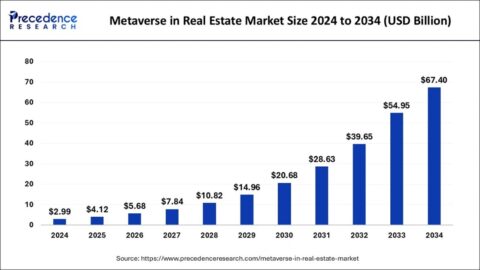

According to a recent report by Precedence Research published in June 2025, the global metaverse real estate market was valued at USD 2.99 billion in 2024, is expected to reach USD 4.12 billion in 2025, and is projected to soar to USD 67.40 billion by 2034, growing at a compound annual growth rate (CAGR) of 36.55%. This remarkable surge is fueled by the rise of blockchain-enabled transactions, the expansion of immersive virtual property experiences, and the growing global appetite for digital real estate investments.

Major blockchain-based platforms like Decentraland, The Sandbox, and Otherside enable users to buy NFTs that represent virtual plots of land—each verified and tradable on the Ethereum blockchain. For instance, The Sandbox alone accounted for thousands of land parcels sold in late 2022, some adjacent to branded neighborhoods launched in collaboration with celebrities and cultural icons.

High-profile global brands have already staked claim in virtual real estate. Adidas purchased a 144‑parcel estate in The Sandbox and launched metaverse content in collaboration with Bored Ape Yacht Club. Meanwhile, HSBC entered the metaverse by buying a plot to host a virtual stadium experience, becoming the second global bank to do so. PwC Hong Kong followed suit by investing in Sandbox LAND to explore advisory experiences in decentralized digital spaces.

Virtual assets are governed by NFTs (non-fungible tokens), which verify ownership and enable resale. Developers use AR/VR walkthroughs and 3D twins to attract buyers. Metaverse properties also generate income via advertising, virtual leases, or exclusive experiences.

Thus, investing in metaverse land offers a glimpse into the future of real estate powered by blockchain and tokenization. The concept of owning virtual plots via NFTs mirrors real-world trends where physical properties are being digitized into tradable tokens. The metaverse serves as a testing ground for secure, decentralized ownership, seamless transactions, and fractional investment—principles that are increasingly shaping the future of real estate beyond the virtual world.

Regulatory Readiness: The Final Hurdle

Despite blockchain’s promise, regulatory ambiguity can stall adoption. Jurisdictions vary in how they define tokenized property—some as securities, others as digital utilities.

- Egypt’s Real Estate Regulatory Unit (2025) is among the region’s first to standardize licensing, investor rights, and token classification.

- The World Economic Forum (WEF) and IOSCO are collaborating on international standards to balance innovation and compliance.

By 2030, countries with agile, digital-first policies will emerge as hubs for proptech startups, attracting talent and institutional capital.

Conclusion: From Tool to Infrastructure

he future of real estate in 2030 will not be shaped by simply adding blockchain tools to existing systems—it will be redefined by rebuilding those systems around blockchain infrastructure itself. From verified listings and AI-driven pricing models to fractional ownership and immersive virtual showrooms, blockchain is no longer a complement; it is the core.

A report supported by Chainlink’s analysis estimates a staggering $10.9 trillion market opportunity in real-world asset tokenization by 2030. This shift marks more than a technological upgrade—it signals a paradigm shift in how assets are valued, traded, and secured in the digital age. Blockchain is not just part of real estate’s future. It is the infrastructure upon which that future will be built. In short, blockchain is not just a tool in real estate’s future. It is the backbone.