Following the free float of the EGP, a number of economic and political headwinds were witnessed in the Egyptian real estate scene, pushing companies to be creative in designing, funding, and marketing projects. However, with the fluctuations in the USD exchange rates and recent subsidy cuts, it is certainly important to ask a few questions at this point; how has the EGP flotation impacted the housing sector in terms of implementation costs? A more specific question would be: what kind of imprint do the latest whooping rises leave on both developers and contractors?

To answer these questions, Invest-Gate examines the bigger picture to assess such concerns from a strategic standpoint, identify means of coping with higher costs and changing market trends, and provide some forecasts on how this issue will unfold.

Looming Specter of Implementation Costs

Real estate and construction sectors are essentially two sides of the same coin; they are often existing side by side and are mutually reinforcing, each contributing to and accentuating the other. Concerning the Egyptian building industry, it is bracing both the best and worst of times.

At the outset, the state has placed the construction sector at the heart of its economic agenda, ensuring that there will be a profusion of contracts available in this juncture and the foreseeable future. Per contra, efforts to reform economic conditions, through the removal of fuel subsidies and the EGP flotation in November 2016, have resulted in some price pressures and detrimental effects on contractors.

In June 2017, the petroleum ministry announced fuel price hikes of up to 50% to help meet the terms of the USD 12-bn International Monetary Fund (IMF) loan deal, the second increase since the currency flotation. In addition, under the latest round of subsidy removal in June 2018, fuel prices for brick and cement makers rose by 40%, from EGP 2,500 to EGP 3,500 per ton, Petroleum and Mineral Resources Minister Tarek El Molla earlier stated in an official statement during the same month.

It was not only the removal of fuel subsidies that heavily affected the Egyptian market, but electricity prices also shot up across the board. With the first round of increase taking place in August 2016, new cuts to electricity subsidies were embraced in June 2018, raising prices by an average of 26% from July 2017 and resulting in a 42% surge in electricity costs for factories, according to Electricity Minister Mohamed Shaker. Furthermore, the government has said electricity subsidies will be completely phased out by the end of FY 2021/22, aiming to keep the country’s subsidy reform program on track.

With mechanical and electrical strains combined, property developers reported that the cost of raw materials had jumped by 300% since 2015, bracing a simultaneous rise in unit prices, according to Oxford Business Group’s (OBG’s) “The Report: Egypt 2018.”

CEO of Beta Egypt for Urban Development Alaa Fikry confirmed, “[The company] has witnessed an 80% hike in its planned costs, due to the rise in building prices following the EGP flotation.” Likewise, Ahmed Sabbour, CEO of Al Ahly Sabbour Developments, said in a press roundtable covered by Invest-Gate on March 10, “Following the EGP flotation, implementation costs spiked by 42%,” expecting a 20% increase in unit prices, particularly after the climbing prices of fuel, as well as, rising prices of steel and cement.

In a bid to develop a wider scope to properly assess the market, here is a yearly chronicle of the estimated prices of building materials since the EGP devaluation until February 2019, provided by Invest-Gate’s R&A team.

In essence, prices of steel products surged by nearly 100%, hitting EGP 9,000-9,600 per ton in June 2017 versus EGP 7,500 in the year-ago period. Cement prices swelled by the same value, logging EGP 750-900 per ton in June 2017 from EGP 550 a year earlier, Ahmed El Zaini, chairman of the Building Materials Division at the Federation of Egyptian Chambers of Commerce (FEDCOC), earlier told the local press. However, during the coming period, the official expects a decline in cement prices after the Beni Suef Cement Plant starts operating at full tilt, as well as, the return of Sinai factories’ operations on a regular basis following a long-term halting of production at Arish Cement Factory.

Flotation Aftermath on Primary Market

There is no doubt that the whooping hikes had some knock-on effects on the Egyptian real estate market as property developers had already been obliged to up their prices under such circumstances due to the consequent increase in implementation costs. Within a week or two after the devaluation, most housing companies had soared their prices by 15 to 20% to maintain profitability.

In this regard, it is certainly important to thoroughly analyze the real estate developers’ profitability over the course of the past four-year period and compare their performance now and then. After all, one might assume that a problem of affordability may arise on the supply line, yet, this was not the abstract trend for most companies, at least for the listed ones.

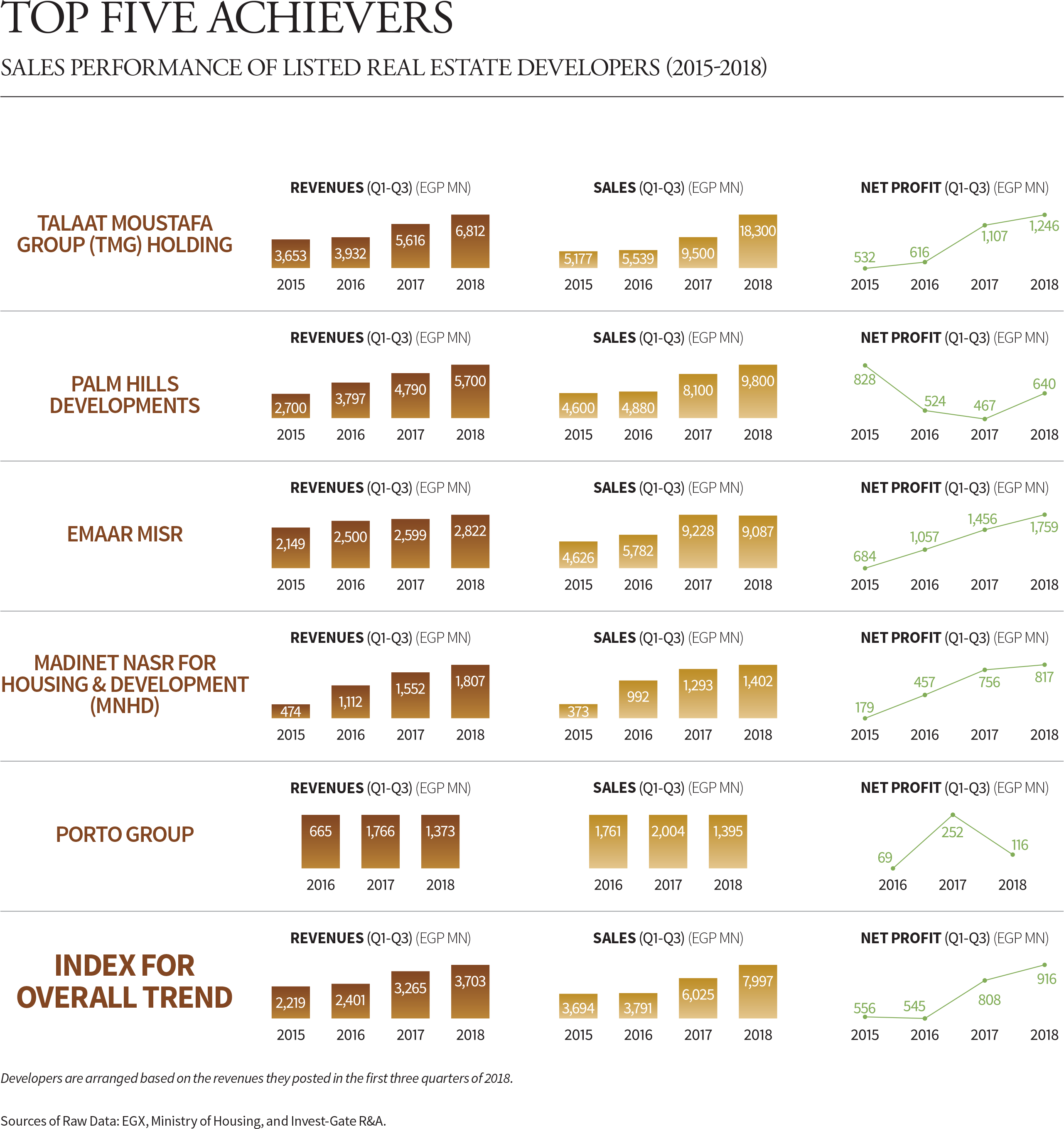

Beating the odds, strong sales throughout the past period have kept the property sector on track, with most developers logging a solid increase in sales, revenues, and net profits. Generally speaking, listed real estate companies’ revenues rose to EGP 3.7 bn in the first three quarters of 2018 from EGP 2.4 bn in the same period in 2016, while recording higher net profit of EGP 916 mn in Q1-Q3 2018 versus EGP 545 mn in the corresponding period of 2016.

The listed developers also witnessed an upsurge in their contracted sales, logging almost EGP 8 bn during the first three quarters of 2018, compared to EGP 3.8 mn in the same period of 2016 – with Talaat Moustafa Group (TMG) Holding and Palm Hills Developments chipping in with record-high sales of EGP 21.3 bn and EGP 10.5 bn, respectively, in FY 2018.

Such exceptional performance can be attributed to the fact that the fluctuations in the local currency, together with soaring inflation rates, have lured buyers to the property investment market. This is mainly because consumers had a greater incentive to buy now rather than wait, especially those looking to hedge against the post-float mounting prices, seeing home-ownership a stable investment opportunity despite various periods of uncertainty and instability. As a result, demand for real estate continues to outstrip supply, even amid pressures on developers to raise prices further due to foreign currency shortages, soaring construction costs, and weakening local currency.

When Invest-Gate spoke to Mena Group Founder Fathallah Fawzy back in January, he said there are 150 developers currently operating in the Egyptian market, delivering 25,000 units annually for upper-middle and upper-class housing, 80% of which are located in Greater Cairo – especially its east and west edges. However, Colliers International argues that such supply still comes up short. It predicts that almost 90,000 to 100,000 units will be needed per year by 2020 to fill the gap. Consequently, there is a substantial opportunity for revenue generation among volume-driven segments.

So What’s Next?

The promise of appreciating property values has supported demand for real estate thus far, but spiraling inflation may seriously erode buyers’ affordability for houses. Some developers remain bullish about the prospects for the sector moving forward, and certain trends point towards an imminent upturn.

Beta Egypt’s Fekri anticipates that the first quarter of 2019 will see lower real estate sales than the same period last year. He attributed his forecast to the expected new price hikes and added taxes, which are to be reflected on unit costs and consumers’ purchasing power.

He also argues that interest rates of lands offered by the New Urban Communities Authority (NUCA) are currently sky-high, adding that the authority has to reconsider such interest rates to stimulate the country’s urban area development.

On another note, the upswing in demand in the market is largely, although not exclusively, driven by end users. However, the substantial need for housing remains among the lower-income segments of the market that are not captured by private developers. This portion of the Egyptian population can be potential homebuyers and investors if real estate companies fittingly addressed them. Thus, it is certainly time for developers to figure out additional means to provide much affordable housing and to also cater to all classes, and not only the high-end ones, in order to secure higher demand and profit.

Meanwhile, property developers may soon start to gain confidence in the application of such mechanisms for that one of the positive outcomes of the EGP flotation is that Egyptian construction companies are now, more than ever, looking to maximize the usage of local materials. In addition, the government has been exerting efforts to construct new plants and industrial zones to produce raw materials locally. These are all good news for both contractors and developers, and it will certainly be reflected in the implementation and operating costs and may also result in more remarkable market performance and stable unit prices in the future.

At all events, there is no simple solution for Egypt’s housing woes, particularly in the private sector, but what Invest-Gate can foresee is an ascending appetite for real estate although the supply pipeline remains relatively limited for the time being. Although the knock-on effects have dampened the market in general, the medium- to long-term outlook looks more promising, with competition growing among developers and sales steadily climbing as demand and supply revive. This owes to the fact that the sector has long been viewed as a safe financial bet and will remain as such as the local currency stabilizes and foreign investment increases.

Read more about the real estate scene after flotation on pages no. 30-33 of our April issue.