translated by Reem Hassan

The price of construction materials in Egypt has witnessed booming changes since the beginning of 2021, compared to previous year. This has been seen due to radical changes in local and international markets; in addition to that, the consequences of building materials price increase have cast a negative shadow on the Egyptian market. Accordingly, Invest-gate has conducted a survey to find out the main factors behind these changes and its impact on unit prices of various types in the near future.

The construction materials prices upsurged, with around 13% to 51% by end of June 2021 compared to last year, according to an official report issued by the Central Administration for Building Needs and Materials, affiliated to the Ministry of Housing, Utilities and Urban Communities.

Factors Behind Demand Upsurge for Construction Materials

Several factors are contributing to such an upsurge in the prices of construction materials, including a global price increase in raw materials and a recent increase in demand locally, in addition to the implementation of huge national projects.

The Egyptian construction market suffered from recession during 2020, starting by the state banning building licenses for six months back in March 2020 followed by the pandemic outbreak. Construction work had been suspended and precautionary measures had been followed to confront this outbreak. This caused delays in projects delivery, supply chain disruption, production drop, and financial shortfalls, which had negative effects on construction material prices during 2021.

In this regard, an Invest-Gate report entitled “The Latest Construction Headway in Property Market,” issued last April, states that 69% of participants confirmed that contracting companies suffer from financial shortfalls and a severe drop in profits due to the pandemic outbreak.

Besides, the Ministry of Planning and Economic Development (MPED) affirmed that the construction sector shrinks by 9.1% in Q1 2020, which is around EGP 91.35 bn of GDP. In the same context, the Central Bank of Egypt (CBE) stated that this industry witnessed a decline by 5.7% YoY in Q2 2020, before recovering slowly in Q3 of the same year, with a growth rate of 2.6% YoY.

Accordingly, some companies have altered their focus to reinforce their profits and compensate losses due to the pandemic in 2020. At the same time, the local market witnessed a significant increase in prices of most basic construction materials since the beginning of 2021.

The construction materials department in the Chamber of Commerce indicates that the price increase is due to factories maximizing their profits during the current period locally and an increase in prices of raw materials at the international stock exchange, in which the price of pallet per ton was about USD 700, and the price of a scrap per ton was about USD 502.

Main Factors for Demand Upsurge

- Price Increase of Raw Materials and Costs

In July 2021, the price of iron per ton was about EGP 14,800, an increase of 51% vs. June 2020, and the price of cement increased by 39%, rocks and gravels prices raised by 15%, in addition to the prices of other construction materials, according to the construction materials department of the Cairo Chamber of Commerce.

It is noteworthy that Egypt produces about 7.9 mn tons of rebar and about 4.5 mn tons of pallet; meanwhile, it imports 3.5 mn tons of pallet ore, according to the Chamber of Metallurgical Industries. Moreover, there is a strong link between the Egyptian steel industry and the global market because Egypt imports the inputs of production; therefore the global price increase of raw materials will affect the local ones.

On the other hand, the aforementioned Invest-gate report confirmed that 56% of the companies surveyed indicated that the emergency imposed by the pandemic would not cause any fluctuations in the prices of construction materials, however, 25% of respondents said that the pandemic disruptions will lead to higher prices of raw materials due to fluctuations in supply and demand.

Furthermore, the latest survey conducted by Invest-gate indicates that 22.6% of participants believe that the recent increase in raw material prices is one of the main reasons for the upsurge in demand for construction materials locally.

- National Projects: New Cities

Prior to the pandemic crisis, the Egyptian construction sector witnessed rapid growth, with an average annual rate of 9.6% between 2016-2019, according to Global Data, and this comes due to the major projects implemented by the government such as new cities, huge national projects, and infrastructure development.

Besides, the MPED remarks that the state’s efforts in infrastructure projects, new cities, and road networks have contributed to supporting the construction sector, and revitalizing the economic cycle to confront the crisis.

Thus, 77.4% of the participants in Invest-gate’s latest survey attributes the main reason for the increase in demand for construction materials, during the last period, to the establishment of new cities, especially the New Administrative Capital (NAC).

Egypt is on the way to enter an era of smart cities through 14 of the upcoming new cities based on international technological standards in a bid to digitize the next generation of communities and to develop the real estate industry. Moreover, the Egyptian government is also adopting a strategic plan for urban development to increase the built-up areas and establish new urban communities, in which various housing projects, infrastructure, and services are complete.

Besides, many new cities are underway, such as NAC, New Alamein City, and El Galala City to name a few. The total area of new urban communities is about 380,000 acres, and it is planned to accommodate about 14 mn people. Also, the total investments in the existing new cities are amounted to about EGP 77 bn, according to statements of the Ministry of Housing, Utilities, and Urban Communities.

Future Expectations

The increase in prices of construction materials will lead to further changes in the building cost of projects, which are currently ongoing by real estate development companies. This will in return cause an increase in unit prices across the sector whether residential, commercial, and/or administrative.

Across the private sector, some real estate development companies expect that prices of residential units to rise by 10-20% during the last quarter of 2021. In this regard, the construction materials department of the Chamber of Commerce reports that the recent increase in the construction material prices had a negative impact on the prices of the real estate market, which increased between 20-25%, due to the upsurge in the cost of land and construction materials such as rebar and cement, in addition to the growth in the demand volume to purchase new units for housing or investment purposes.

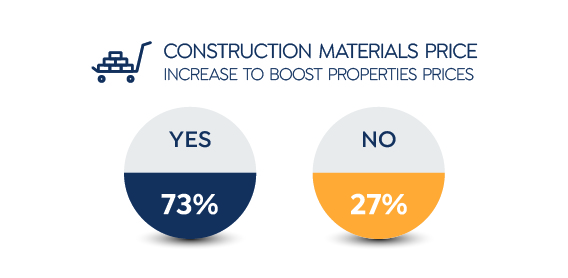

In the same context, 73% of the respondents to the latest Invest-Gate survey see that the rise in construction material prices will lead to an upsurge in property prices during the coming period, however, 27% believe that real estate prices will remain relatively stable.

Accordingly, unit prices will increase in the coming period, especially among the upcoming projects that follow the recent price hike in construction materials. Therefore, real estate companies must create a balance between setting new strategies to avoid losses and accommodate for the purchase power and the affordability within the real estate sector.