International credit rating agency Moody’s Investors Service has maintained its positive outlook for Egypt’s banking sector, on the back of the country’s improving operating conditions, Invest-Gate reports.

“Accelerating growth in Egypt reflects increased public- and private-sector investment, higher exports and a recovery in tourism,” Senior Vice President at Moody’s Constantinos Kypreos said in an official statement on February 11.

The inter-linkages with Egypt’s ameliorating credit profile, amid a buoyant economy, has supported Moody’s positive view of the country’s banking system, the international agency noted in the statement, adding that banks will continue to have a good access to stable, deposit-based funding, and hold large volumes of liquid assets, particularly in local currency.

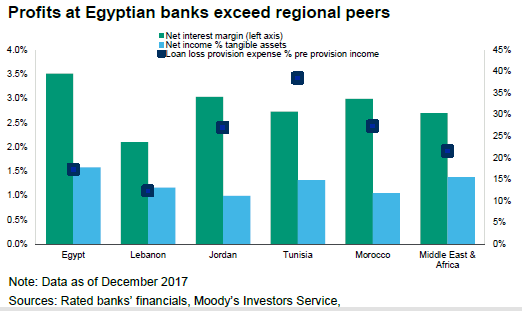

“We expect balance sheet growth of around 15% in 2019 and for banks to maintain ample local currency funding, high liquidity, and strong and stable profitability,” Kypreos confirmed.

funding, high liquidity, and strong and stable profitability,” Kypreos confirmed.

Additionally, Moody’s revealed that Egypt’s real GDP growth is foreseen to hit 5.5% and 5.8% in 2019 and 2020, respectively, while banking penetration is expected to expand, bolstering the country’s deposit and loan growth.

Meanwhile, non-performing loan (NPL) levels within the banking system are set to stay broadly stable, on the back of a rigid economic momentum. According to Moody’s, NPLs at Egyptian banks fell to 4.4% of total loans as of September 2018, from 19.3% in 2007. However, these levels remain vulnerable to a future turn in the economic cycle for the colossal volumes of untested new loans and ongoing security risks.

“Egyptian banks’ high exposure to government securities – at 32% of their assets as of October 2018 – also links their creditworthiness to the sovereign’s,” Moody’s stated.

“However, although foreign-currency funding and liquidity remains adequate, it [the banking system] is under pressure from global financial tightening as already evident by a fall in banks’ foreign assets,” the credit rating agency concluded.