US-based credit rating agency Moody’s has announced its forecasts for the Egyptian economy, following the government’s approval of the budget for the fiscal year 2020, Invest-Gate reports.

Moody’s sees that the continued fiscal consolidation as a credit positive would most likely result in a reduction in the country’s general government debt/gross domestic product (GDP) ratio to 82.3% in FY 2019/20, compared with an estimated 86.3% in FY 2018/19 and an actual 92.6% in 2018, according to the agency’s report released on April 3.

Despite a marginally lower overall growth forecast at 5.8% for FY 2019/20, Moody’s expects the fiscal deficit to be 7.5% of the total GDP, while the primary surplus will be 1.7% of GDP.

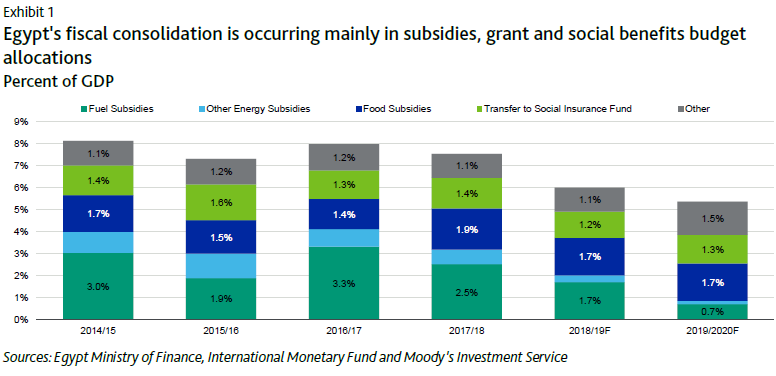

The agency further attributes the budgeted deficit reduction of about one percentage point of GDP to a reduction in expenditures, and the projected decrease in the share of subsidies, grants, and social benefits to 5.4% of GDP in FY 2019/20 versus an estimated 6% in FY 2018/19.

The budget, currently being discussed in the parliament, targets an economic growth rate of 6%, with a reduction in the overall deficit to 7.2% of GDP and a primary surplus of 2% of GDP.