The National Bank of Kuwait (NBK) has recently found that the Egyptian economy’s performance promises hopeful prospects, as the worst repercussions of the novel COVID-19 crisis wears off, Invest-Gate reports.

Egypt’s economic activity slowed in Q2 2020 amid COVID-19 lockdown measures, according to NBK.

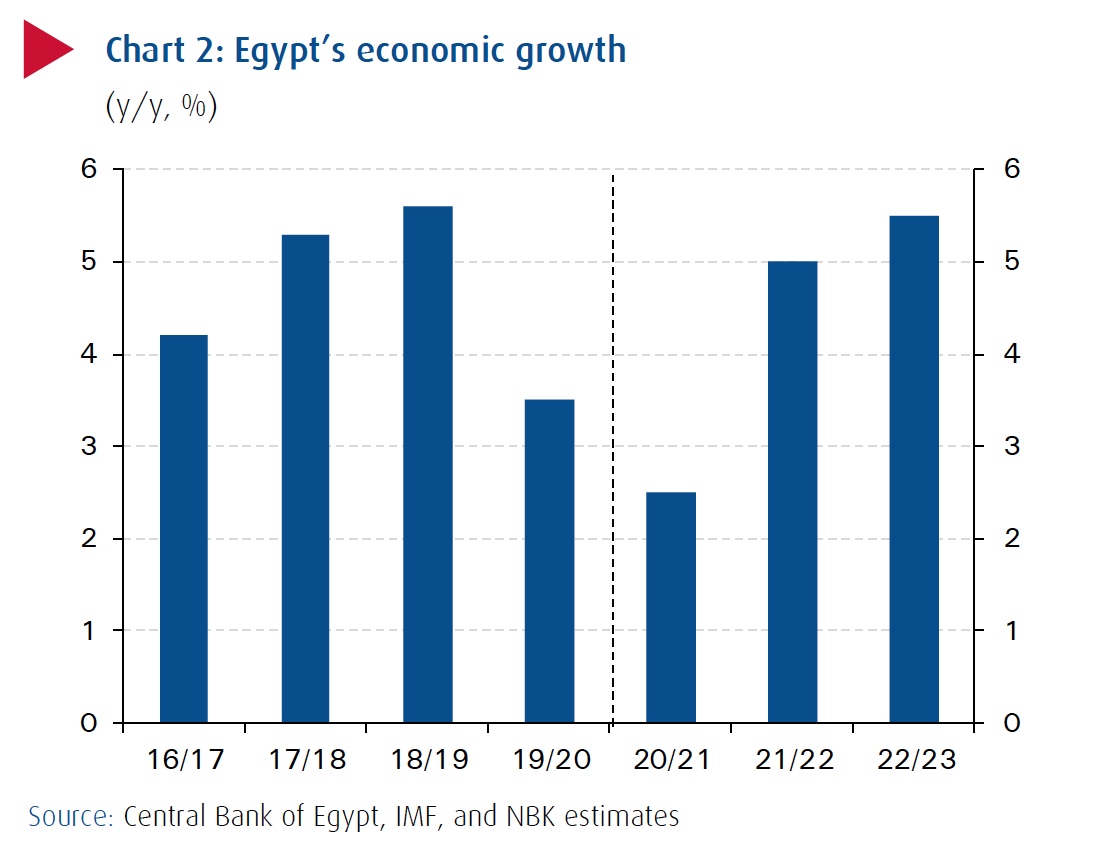

Despite the outbreak fallout, preliminary figures showed that real GDP grew by 3.6% in FY 2019/20, compared to 5.6% a year earlier. Further, the enforcement of closures to contain virus spread led to a 1.7% decline in Q2 2020 versus 5% in the previous quarter, according to NBK’s latest Quarterly Economic Brief.

“Egypt continued to make progress on its public finances, putting the budget deficit on a downward trend, despite the impact of the pandemic on the fiscal position in the first half of 2020,” read the report, noting that such results reflect a healthy return to pre-Coronavirus business activities with the gradual lifting of the precautionary restrictions.

“However, Egypt’s economic growth is projected to slow further to around 2.5% in FY 2020/21, and to rebound strongly to about 5% over the medium term, benefitting from the authorities’ commitment to reforms and a renewed [International Monetary Fund] support,” it added.

NBK estimates, on the other hand, claim the country’s main economic indicators are still showing a gradual recovery, as the key PMI had seen an upward trend, rising to 51.4 in October to approach a six-year high, compared to 50.4 in September. That is as a result of Egypt’s key PMI averaging 49.8 and 38.3 in Q2 and Q3 2020, respectively.

Another indicator is unemployment rates plummeting to 7.3% in Q3 2020, which reflects the return of commercial activities to normal levels. This improvement also comes in light of the gradual easing of government-dictated preventive measures as of July.

Besides, there has been a continued improvement in foreign reserves for the fifth consecutive month, rising by USD 795 mn to reach USD 39.2 bn in October, compared to USD 36 bn in May, when it retreated to its lowest levels during the peak of the ongoing germ episode.

That is supported by Egypt’s trend towards securing more financial buffers, on top of the recent acceleration of capital flows. The bank also highlighted the significant drop in inflation rates, adding that since the beginning of the implementation of macroeconomic reforms in late 2016, urban inflation has taken a downward trend.

Such a turn-back makes Egypt one of the few countries to witness a sharp decline in inflation rates, from about 33.1 % in July 2017, over a relatively short period. Therefore, it is expected that growth will pick up starting from H1 2021, “in hopes of rolling out vaccines by the end of this year,” NBK concluded.